Tampons, Taxes, and the Fight for Equality in California

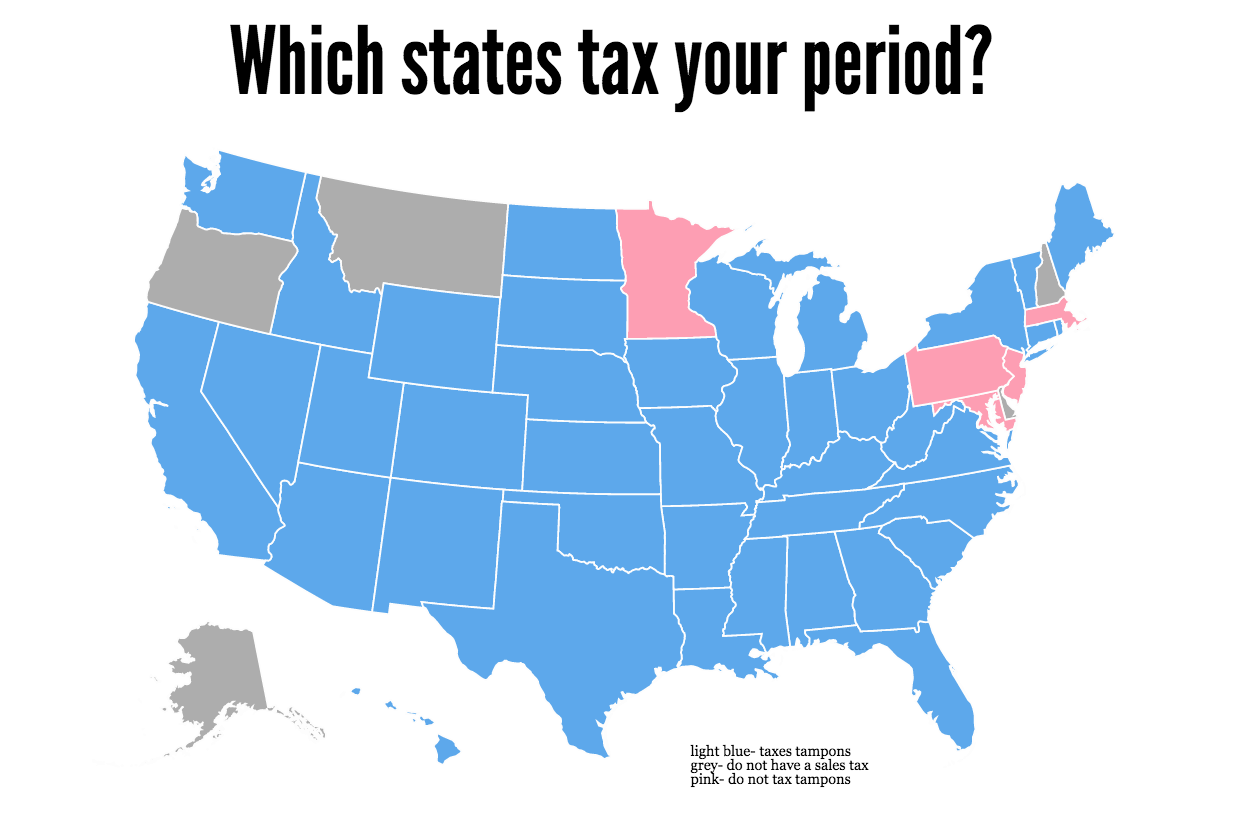

Most U.S. states tax feminine hygiene products. (Assemblymember Cristina Garcia)

Chapstick, dandruff shampoo, and Viagra all share one thing in common: there is no sales tax on these products in many states. Meanwhile, tampons and other menstrual products are being taxed in more states than not. Taxes on tampons will cost consumers between $100 to $225 in a lifetime. While that may not seem like a lot for a lifetime, the government is collecting more than $275 million dollars a year from a basic health necessity. In the last five years, California has been leading a major push to change this.

In 2016, Assemblymember Cristina Garcia and Assemblymember Ling Ling Chang introduced AB 1561, which came to be known as the “tampon tax.” It was a bipartisan bill that in June 2016 reached Governor Jerry Brown’s desk. Three months later, Governor Brown vetoed AB 1561, citing financial concerns and concluding that, “Tax breaks are the same as new spending.”

In 2017, Assemblymember Garcia introduced the bill again, but it did not pass the assembly, where it was introduced. It is speculated that the assembly rejected Garcia’s bill because counties and cities would not be reimbursed for the revenue lost from the tampon tax. From the assembly members’ perspectives, it would be hard to explain to their constituents how they planned to find funds to replace the revenue loss, which would be potentially damaging to their reelection campaigns. Furthermore, Assemblymember Garcia came under fire in 2017 when one of her political opponents and fellow Democrats Daniel Fierro claimed that Garcia, chair of the Women’s Caucus and a leader of the #MeToo movement, drunkenly groped his body. These claims were thoroughly investigated and found to be false. Although she was not found guilty of sexual harassment toward Daniel Fierro, she was found guilty of vulgar language with others and was thus forced to take disciplinary classes.

Despite recent events, Assemblywoman Garcia is continuing her fight to remove the tampon tax for Californians. In December 2018, she introduced her bill again, with the outcome of the tampon tax bill, introduced as AB 31, looking brighter than before. The bill itself has been proven to pass through the legislative body and the greater obstacle, the governor, has now changed. Governor Gavin Newsom has recently declared himself as a feminist and proven this by declaring that he would budget nearly $2 billion towards early childhood education and six months of paid family leave.

So, what is the tampon tax? Unfortunately, the layman's term for this bill is misleading since the bill’s goal is to remove the sales tax from menstrual products. According to the National Public Radio, “While there is no specific tax on tampons, in states that don't tax medical and health supplies, tampons are excluded from those tax-exempt categories. Hence the term ‘tampon tax.’" The feminist movement took a liking to this bill. Ten other states followed Garcia’s lead. Meanwhile, three other states are in the process of making a decision to exempt taxes on menstrual products.

In less than five years, there has been increasing traction for the “tampon tax.” Prominent politicians such as President Barack Obama have spoken in support of the “tampon tax.” There has even been an ongoing movement at the UC Davis campus among feminist circles. Kristen Leung, an officer in PERIOD, which focuses on making menstrual products available for all students and IGNITE, which focuses on inspiring all women to run for office, says, “If cis-men menstruated, we would have free menstruating products from day one.”

In fact, their claim is not wrong when you analyze how sildenafil or the name-brand version Viagra came to be tax-exempted. Viagra is meant to treat erectile dysfunction and pulmonary hypertension. The latter can be resolved with other medicines. Therefore, the requirements to exempt Viagra from the sales tax is perfectly legal since it is considered to be a medical device or drug. However, it is incredibly economically misguided when there are unresolved solutions in need of budget space, such as tampons and pads.

There are federal assistance programs such as Supplemental Nutrition Assistance Program and Women, Infants, and Children that don’t cover the costs for menstrual products, despite its classification as a medical device. Overall, this is why many Americans have begun to believe that the penis is prioritized, but women’s suffering is normalized. This bill evokes the equal protection clause of the 14th Amendment: “nor shall any State... .deny to any person within its jurisdiction the equal protection of the laws.”

Garcia’s AB 31 was recently heard at the Committee on Revenue and Taxation on March 18. Despite the large turnout to advocate for the bill, it has not yet been voted on. It appears that further social pressure is needed in order to push the bill forward, but as the famous philosopher Georg Wilhelm Friedrich Hegel once said, “Nothing great in the world has even been accomplished without passion.”

Edit added February 4th, 2020

For more information more about the Pink Tax and how to avoid it, here is an informative guide by Bankrate:

https://www.bankrate.com/finance/credit-cards/pink-tax-how-women-pay-more/